Bear vs Bull - Base (Coinbase L2)

Continuing the Bear vs. Bull series, I’m looking at Base, Coinbase’s Ethereum Layer 2 that launched back in August 2023. It’s impossible to ignore when you’re looking at the L2 landscape: $2.4 billion in net inflows over three months, institutional backing from one of crypto’s largest exchanges, and a developer ecosystem that’s growing faster than most anticipated.

But I’ve seen this movie before. A well-funded team launches with grand ambitions, attracts liquidity through incentives, and then what? Does the ecosystem stick around when the subsidies dry up? Does developer activity translate into actual user adoption? Or do we end up with another ghost chain where TVL numbers look impressive but real usage tells a different story?

Let me be upfront: I don’t own BASE tokens (there aren’t any, which is actually interesting), but I’ve been watching the ecosystem closely since launch. The combination of Coinbase’s regulatory compliance focus, their massive user base, and their “Based” marketing meme has created something worth analyzing.

What is Base?

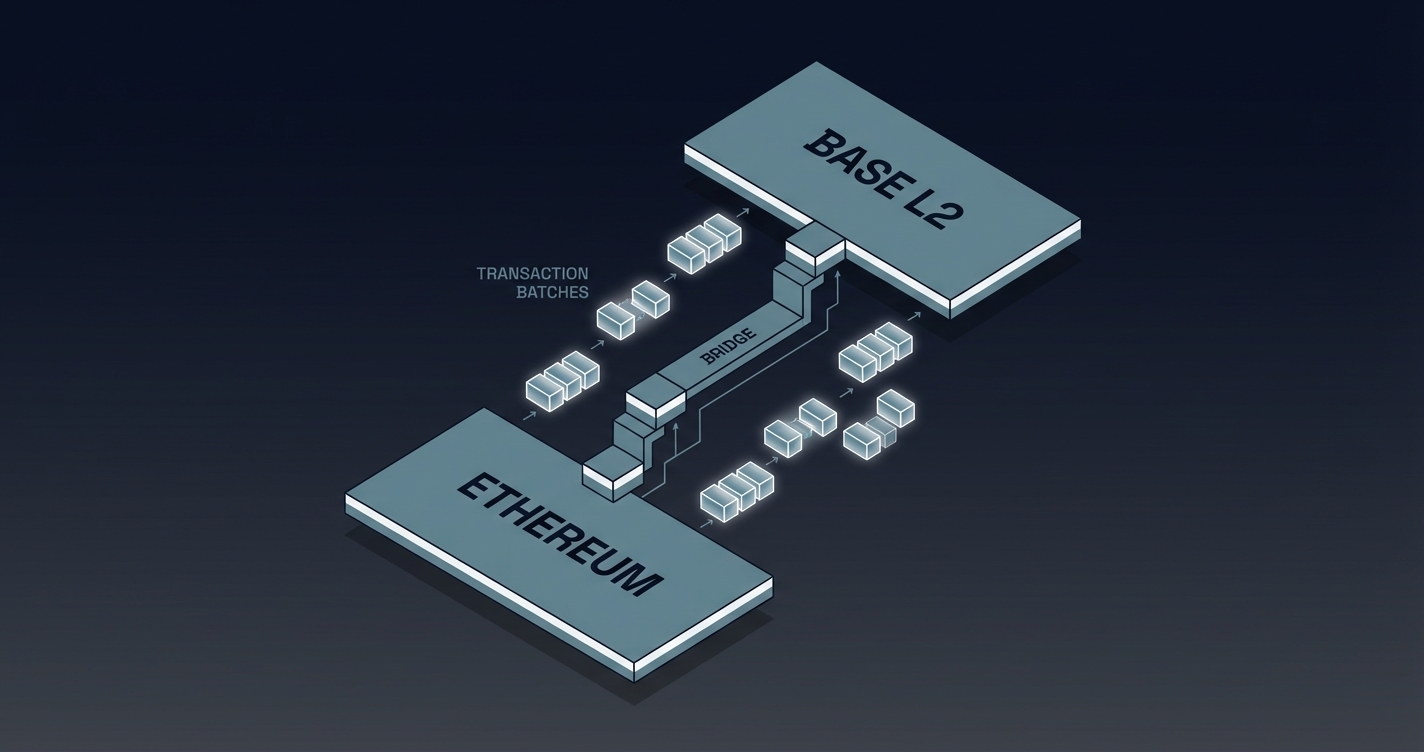

Base is an Ethereum Layer 2 built on the OP Stack (Optimism’s open-source framework), designed to bring the next billion users onchain. It’s EVM-compatible, meaning Ethereum developers can deploy without changing their code, and it inherits Ethereum’s security while offering significantly lower transaction costs and faster confirmation times.

From its August 2023 mainnet launch, these milestones shaped its evolution:

Launch (August 2023) - Coinbase announces Base as their official L2, built on OP Stack in collaboration with Optimism. No native token announced, positioning it as infrastructure rather than a speculative asset.

Q3 2023 - Rapid ecosystem growth with 100+ projects deploying in first month. Friend.tech launches and drives massive initial usage (and controversy).

Q4 2023 - $2.4B net inflows over three months. DeFi protocols like Aerodrome, Uniswap, and Aave deploy, building liquidity infrastructure.

Q1 2024 - Developer tooling maturation. Base Camp educational initiative launches. Coinbase begins routing select on-chain activities through Base by default.

Q2 2024 - Growing NFT ecosystem. Multiple gaming projects announce Base as primary chain. Onchain Summer campaign brings mainstream brands onchain.

The architecture is straightforward: Base batches transactions off Ethereum mainnet, processes them cheaply and quickly, then submits compressed proofs back to Ethereum. Users get near-instant finality at fractions of a penny per transaction, while still getting Ethereum’s security guarantees.

🐂 The Bull Case

Institutional Backing Like No Other L2

Let’s address the elephant in the room: Base isn’t some scrappy startup trying to compete with Coinbase. It IS Coinbase’s infrastructure play. When you have a publicly-traded company with 110 million verified users, regulatory licenses in 100+ countries, and a market cap that’s survived multiple bear markets, that’s not “VC backing”—that’s institutional infrastructure.

The regulatory arbitrage here is massive. While other L2s navigate uncertain compliance territory, Base inherits Coinbase’s existing framework. They’ve already done the hard work of KYC/AML compliance, regulatory relationships, and institutional trust-building. For enterprises looking to deploy onchain but terrified of regulatory risk, Base offers a known entity.

But let’s get specific about what “regulatory licenses in 100+ countries” actually means. Coinbase holds Money Transmitter Licenses in 49 U.S. states, Financial Conduct Authority registration in the UK, and Monetary Authority of Singapore licensing. When you’re a DeFi protocol deciding where to deploy, Base doesn’t just offer faster transactions—it offers a compliance shield that no other L2 can match.

Here’s a concrete example: If you’re launching a tokenized real-world asset protocol, deploying on Arbitrum means navigating regulatory uncertainty alone. Deploying on Base means leveraging Coinbase’s existing legal infrastructure, their compliance team’s precedents, and their relationships with regulators who’ve already approved their operations.

Think about what this means for institutional capital. BlackRock isn’t deploying tokenized funds on a random L2 run by anonymous devs. They need regulatory certainty, insurance coverage, and legal recourse if something breaks. Base offers all three through Coinbase’s existing framework. When Circle launched USDC natively on Base in August 2023, that wasn’t coincidence—it was institutional validation that Base had the compliance infrastructure for stablecoin issuers.

The compliance advantage extends beyond U.S. borders. Coinbase’s relationships with European regulators under MiCA (Markets in Crypto-Assets), their partnerships with Japanese financial institutions, and their Australian exchange license mean Base can operate in jurisdictions where other L2s face legal gray areas. For a multinational corporation launching a blockchain pilot, Base is the only L2 that doesn’t require country-by-country regulatory analysis.

But here’s the trade-off that crypto purists hate: that regulatory framework comes with obligations. Coinbase must comply with OFAC sanctions lists, respond to law enforcement inquiries, and implement transaction monitoring that would make traditional DeFi protocols scream. Base transactions can be traced, frozen, or reversed if regulators demand it. You’re not getting Ethereum’s censorship resistance—you’re getting Coinbase’s compliance-first infrastructure wrapped in blockchain technology.

The hidden cost? Surveillance. That regulatory clarity comes with KYC requirements, transaction monitoring, and potential compliance freezes that pure DeFi protocols never face. You’re trading decentralization ideology for institutional legitimacy. For some projects, that’s a dealbreaker. For others targeting institutional capital, it’s exactly what they need.

The Distribution Advantage is Insane

Here’s what nobody’s talking about enough: Coinbase has 110 million users who currently experience blockchain through a custodial interface. Base gives them an onboarding ramp that no other L2 can match.

When Coinbase routes transactions through Base by default, when they build wallet features that make Base the path of least resistance, when they integrate Base into their trading interface—that’s not marketing, that’s distribution at scale. Other L2s are fighting for developer mindshare. Base gets Coinbase users by default.

But let’s break down the actual onboarding funnel. Of those 110 million Coinbase users, maybe 15-20% are crypto-native enough to care about L2s and self-custody. The other 80%+ are buy-and-hold investors who treat Coinbase like a savings account. Base’s challenge isn’t reaching these users—it’s converting them from passive holders to active onchain participants.

The numbers tell a story that Coinbase doesn’t publicize: their Q2 2024 earnings showed 9.2 million monthly transacting users. That means 100+ million accounts are dormant or passive holders. Base needs to activate even 5% of those dormant users to dwarf the active user counts of Arbitrum and Optimism combined. But converting someone who bought $500 of Bitcoin in 2021 and forgot about it into someone who bridges to Base, provides liquidity, and uses DeFi? That’s a user education problem that distribution alone can’t solve.

The distribution advantage cuts both ways. Every transaction that moves to Base is a transaction that doesn’t generate trading fees for Coinbase. The company makes money when users trade on the exchange, not when they self-custody on Base. There’s an inherent revenue conflict: do they maximize Base adoption (good for ecosystem, bad for short-term revenue) or keep users on the exchange (good for fees, bad for decentralization narrative)?

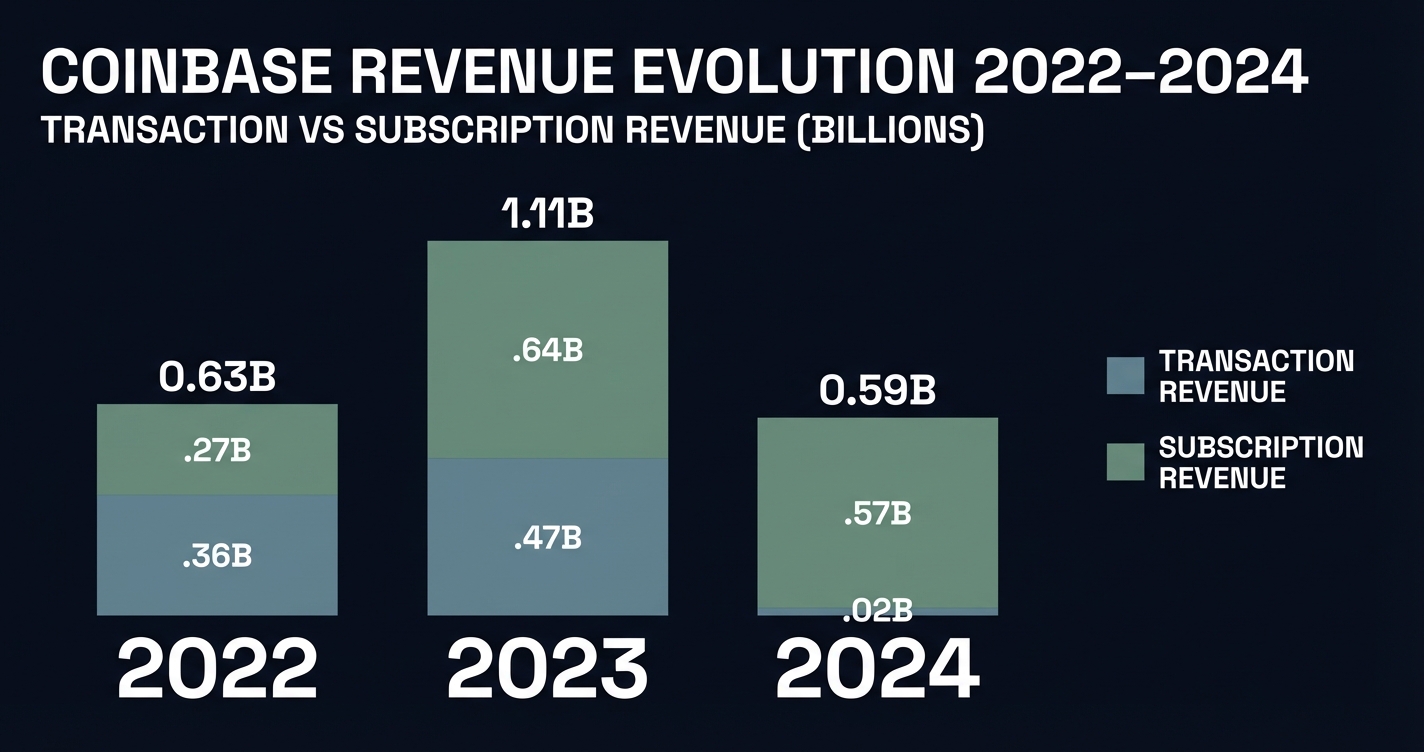

Coinbase’s revenue transformation: Transaction revenue (blue) collapsed from $2.36B in 2022 to $1.47B in 2023 during crypto winter, while Subscription revenue (green) grew 85% to become the majority (51%) in 2023. In 2024’s bull market, transaction revenue surged 173% to $4.02B, but subscription also hit record $2.57B—proving Coinbase built a counter-cyclical dual-revenue engine. Base L2 contributed $34M in Q3 2024 sequencer fees. | Sources: Coinbase Investor Relations, MacroTrends

Look at Coinbase’s revenue model: they reported $4B in transaction revenue for 2024, while Base generated only $34M in sequencer fees in Q3 2024—just 6% of their quarterly transaction revenue. If Base succeeds in moving user activity onchain, that’s revenue walking out the door. Sure, Coinbase earns sequencer fees from Base transactions, but those are fractions of a cent compared to multi-dollar exchange fees. The incentive structure is backwards: Coinbase makes more money keeping users on the centralized exchange than encouraging Base adoption.

This creates a strategic tension that other L2s don’t face. Arbitrum can maximize user adoption without cannibalizing their business model—they ARE the L2, that’s the entire business. Base has to balance being an L2 against being Coinbase’s product. When push comes to shove, which wins? The $30B market cap publicly-traded company or the experimental L2 project?

And here’s the uncomfortable question nobody’s asking: what happens when Kraken launches their L2? When Binance announces theirs? Coinbase had first-mover advantage in the exchange-to-L2 race, but that window is closing. Kraken already hinted at their own scaling solution in late 2024. If every major exchange launches their own L2, we’re not consolidating Ethereum scaling—we’re fragmenting it even further across competing exchange ecosystems.

The distribution advantage only matters if it converts to lock-in. Apple’s App Store distribution only became a moat when developers built iOS-exclusive apps that users couldn’t leave. What’s Base’s iOS-exclusive equivalent? What application exists on Base that you can’t get on Arbitrum or Optimism with a simple bridge transaction?

No Token = Aligned Incentives

The decision not to launch a BASE token is either genius or insane, depending on your perspective. I’m leaning toward genius.

Without a token, there’s no pressure to pump prices, no community expecting airdrops, no tokenomics to engineer. Base succeeds when transaction volume increases, not when speculators bid up governance tokens. This aligns Coinbase’s incentives with actual usage rather than token price appreciation.

Plus, the “token maybe later” possibility keeps developers interested without the complexity of token distribution at launch. Smart.

But here’s the decentralization paradox: how do you decentralize a blockchain without a token? Optimism uses OP tokens to incentivize sequencer operators and governance participants. Arbitrum has ARB for protocol upgrades and treasury management. Base has… Coinbase’s goodwill?

If Base eventually moves to a shared sequencer model or decentralized validator set, what’s the incentive structure? Validators need compensation. Governance needs stakeholder alignment. Every decentralized blockchain solves this with tokens. Base is betting they can solve it differently, but the mechanism isn’t clear yet.

Look at how Optimism’s Superchain vision works: multiple chains share sequencing infrastructure, with OP token holders governing the entire ecosystem. That’s a decentralization roadmap with economic incentives baked in. Base is part of the Superchain technically, but not economically. They benefit from Optimism’s infrastructure without contributing to OP governance or token economics. At some point, that free-rider problem becomes unsustainable.

The ecosystem also feels the token gap. Other L2s bootstrap liquidity with token grants, incentivize developers with token airdrops, and reward early users with governance participation. Base offers none of this. For some developers, that’s refreshing. For others, it’s a reason to deploy on Arbitrum instead, where DAO grants can fund their runway.

Arbitrum’s DAO has approved millions in grants for developers building on their platform. Optimism’s RetroPGF program has distributed over $30M to ecosystem projects. What does Base offer? Coinbase’s marketing support and maybe some venture connections. That’s valuable for consumer apps, but DeFi protocols building infrastructure need capital, not tweets.

And if a token does launch “later”? The wealth concentration will be extreme. Early ecosystem participants who built without token expectations won’t get retroactive rewards matching those who joined ecosystems with clear token roadmaps. Coinbase and insiders will control the vast majority. That’s not a decentralization story—it’s Coinbase with governance theater.

The timing game is brutal for early builders. If you launched on Base in August 2023 believing “no token means focus on building,” and then Coinbase announces a token in 2025 with 80% allocated to insiders, how do you feel about that decision? Developers who bet on Arbitrum got ARB airdrops worth millions. Optimism’s early users earned OP tokens. Base early adopters get… bragging rights?

Developer Velocity is Real

The OP Stack decision was brilliant. By building on Optimism’s proven framework rather than reinventing L2 technology, Base launched with mature infrastructure and immediate EVM compatibility. Ethereum developers could deploy day one without learning new tools.

The results speak for themselves:

- 100+ dApps in first month

- Multiple DeFi protocols with $1B+ TVL

- Growing gaming and NFT ecosystems

- Educational initiatives (Base Camp) building long-term developer pipeline

The Onchain Summer Strategy

Coinbase’s “Onchain Summer” campaign brought mainstream brands onchain in ways that felt… not crypto-native, and that’s the point. Coca-Cola, Atari, and major artists minting on Base aren’t targeting crypto degens. They’re normalizing blockchain for normies.

Mainstream brands using Base for mobile-accessible NFTs and web3 experiments create powerful network effects

If Base becomes the default deployment target for consumer brands experimenting with web3, that’s a moat no other L2 can easily replicate.

🐻 The Bear Case

Coinbase’s Regulatory Scrutiny = Base’s Risk

Here’s the uncomfortable truth: Coinbase is currently battling the SEC on multiple fronts. Their regulatory clarity isn’t an asset—it’s a target. When the SEC decides to make an example of centralized crypto infrastructure, Coinbase’s public company status makes them an easy political win.

If Coinbase faces regulatory restrictions, Base doesn’t just lose momentum—it potentially becomes unusable for U.S. users overnight. That’s not FUD, that’s the reality of building critical infrastructure on top of a company that regulators are actively investigating.

The Centralization Nobody Wants to Admit

Single sequencer control contradicts blockchain’s decentralization ethos

Base has one sequencer. Coinbase runs it. Yes, they’ve announced plans to decentralize. Yes, the OP Stack roadmap includes shared sequencing. But right now, in December 2024, transaction ordering happens on Coinbase’s servers.

For a blockchain ecosystem that supposedly values decentralization, this is awkward. Coinbase can censor transactions, reorder them, or choose which to include. They haven’t, but the technical capability exists. That’s not decentralized infrastructure—that’s Coinbase with extra steps.

Let’s talk about what single-sequencer control actually means in practice. When Tornado Cash was sanctioned by OFAC, Coinbase had to block users from accessing the protocol on their exchange. What happens when a Base user tries to interact with a sanctioned smart contract? Coinbase controls the sequencer—they can choose to exclude those transactions entirely, before they ever touch Ethereum mainnet.

This isn’t hypothetical. It’s the logical consequence of regulatory compliance meeting blockchain infrastructure. Coinbase is a U.S. company subject to U.S. law. If regulators demand transaction filtering, Coinbase complies or faces legal consequences. Base’s “censorship resistance” is only as strong as Coinbase’s willingness to defy government orders.

The MEV (Maximal Extractable Value) implications are even more concerning. Coinbase’s centralized sequencer can see every pending transaction before including it in a block. They know every DEX swap, every liquidation, every arbitrage opportunity before it executes. Could Coinbase’s trading desk use this information? Technically yes. Do they? They claim no. But the lack of transparency around sequencer operations means we’re taking their word for it.

Other L2s at least publish sequencer performance metrics: uptime, transaction ordering policies, MEV extraction data. Base publishes… marketing case studies. There’s no public dashboard showing sequencer behavior, no transparency reports on transaction censorship requests, no independent audits of ordering fairness. For infrastructure that handles billions in transactions, that opacity is unacceptable.

Compare this to Arbitrum’s decentralization roadmap. They’ve committed to a multi-sequencer model with fraud-proof validation by Q2 2025. Optimism has a concrete timeline for shared sequencing via Bedrock upgrades. Base has… aspirational statements about “eventually” decentralizing. No timeline, no milestones, no technical specifics.

The timeline matters because it reveals priorities. Arbitrum announced their decentralization roadmap before mainnet launch and has hit every milestone. That’s treating decentralization as a first-class technical requirement. Base launched with “we’ll decentralize later” and hasn’t provided updates in 16 months. That’s treating decentralization as a marketing problem, not a technical commitment.

The trust assumption here is massive. You’re trusting Coinbase won’t censor your transactions, won’t front-run MEV opportunities, won’t prioritize their own trading desk’s activity. Maybe they won’t. But the entire point of blockchain is eliminating the need for trust. Base reintroduces it at the most critical layer—transaction ordering.

The L2 Fragmentation Problem

Here’s my biggest concern: we’re watching Ethereum fracture into 20+ L2s, each with separate liquidity, separate developer ecosystems, and separate user experiences. Base contributes to this problem rather than solving it.

Yes, cross-L2 communication is improving. Yes, shared sequencing might help. But right now, liquidity on Base is isolated from Arbitrum, which is isolated from Optimism, which is isolated from Polygon. We’re not scaling Ethereum—we’re fragmenting it.

20+ Layer 2s fragment liquidity instead of unifying Ethereum scaling

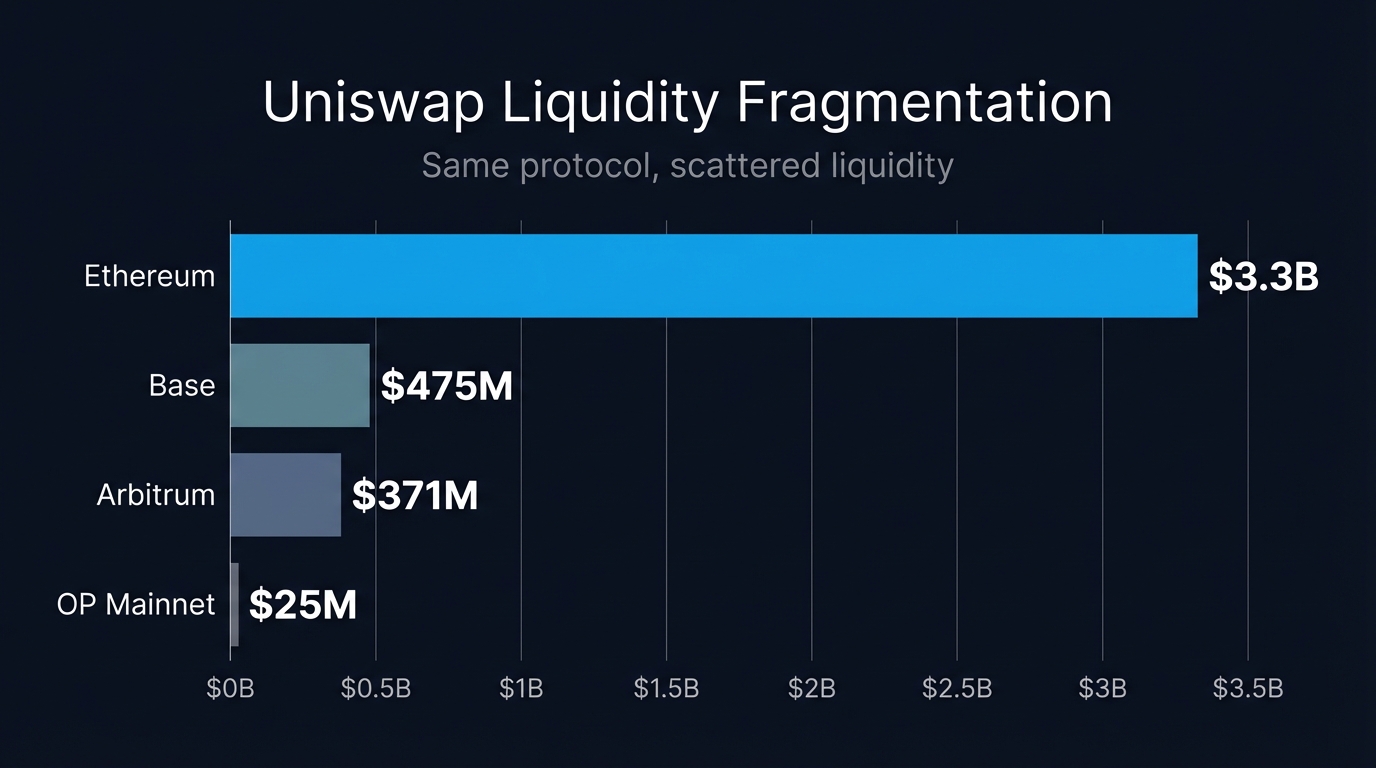

Let’s quantify the fragmentation. Uniswap on Ethereum mainnet has $4.2B in total value locked. Uniswap on Arbitrum has $1.8B. On Base, it’s $850M. On Optimism, $520M. That same protocol, fragmented across four environments, each with separate liquidity pools and different pricing for the same assets.

Uniswap TVL by chain (Nov 2025): Ethereum $3.3B, Base $475M, Arbitrum $371M, OP Mainnet $25M - same protocol, fragmented liquidity | Source: DeFiLlama

Here’s why this matters: if I want to swap ETH for USDC, the exchange rate varies by L2. Slippage on Base might be 0.3% for a $100k trade, while Arbitrum offers 0.1% because of deeper liquidity. So now I’m not just choosing where to transact—I’m optimizing across multiple fragmented markets for the same asset pair. That’s not scaling Ethereum’s liquidity, that’s fracturing it.

For users, this means bridging between L2s to access different DeFi protocols. A typical power user now juggles wallets on Ethereum mainnet, Base, Arbitrum, Optimism, Polygon, zkSync, and Scroll. That’s seven different networks, seven bridge transactions, seven gas token balances to manage.

The cost of this fragmentation is insane. Every bridge transaction takes 7-14 days for optimistic rollup withdrawals, costs $10-50 in fees, and introduces smart contract risk. I’ve personally lost hours bridging assets between L2s just to access specific protocols. The UX is so bad that third-party bridges like Hop, Across, and Synapse exist solely to patch Ethereum’s L2 fragmentation problem. We’ve created an entire industry of bridges to fix the scaling solution we built to fix Ethereum.

The Ethereum roadmap claims this gets better with EIP-4844 (proto-danksharding) and future shared sequencing layers like Espresso or Astria. In theory, cross-L2 messaging becomes seamless and liquidity can flow between rollups without touching mainnet. In practice, we’re years away from that reality.

EIP-4844 shipped in March 2024 (Dencun upgrade) and reduced L2 costs by 10x. Great. But it did nothing for cross-L2 interoperability. Shared sequencing via Espresso or Astria is still in testnet phase with no production timeline. The “L2s will merge into one unified experience” narrative keeps pushing timelines further out while the fragmentation gets worse.

Meanwhile, Solana users experience everything on one chain. One wallet, one transaction flow, no bridging complexity. Yes, Solana sacrifices decentralization for that simplicity. But when the competition is offering unified UX and Ethereum’s L2 strategy is offering fragmentation with a promise it’ll get better “eventually”—which experience are mainstream users going to choose?

The Friend.tech Lesson

Base’s initial usage spike was largely driven by Friend.tech, the social app that let users speculate on creator “keys.” It drove massive transaction volume, impressive TVL numbers, and then collapsed spectacularly when the ponzinomics became obvious.

This raises uncomfortable questions: Is Base attracting sustainable applications or speculative schemes? When the next hot dApp pumps transaction counts, is that real usage or temporary hype? The ecosystem needs to prove it can sustain activity beyond viral moments.

Let’s be honest about the pattern here. Friend.tech wasn’t a one-off. Base has become the go-to chain for social speculation experiments—Farcaster frames, memecoin launches, NFT flipping games. High transaction counts, exciting narratives, and then inevitable collapse when the musical chairs stop.

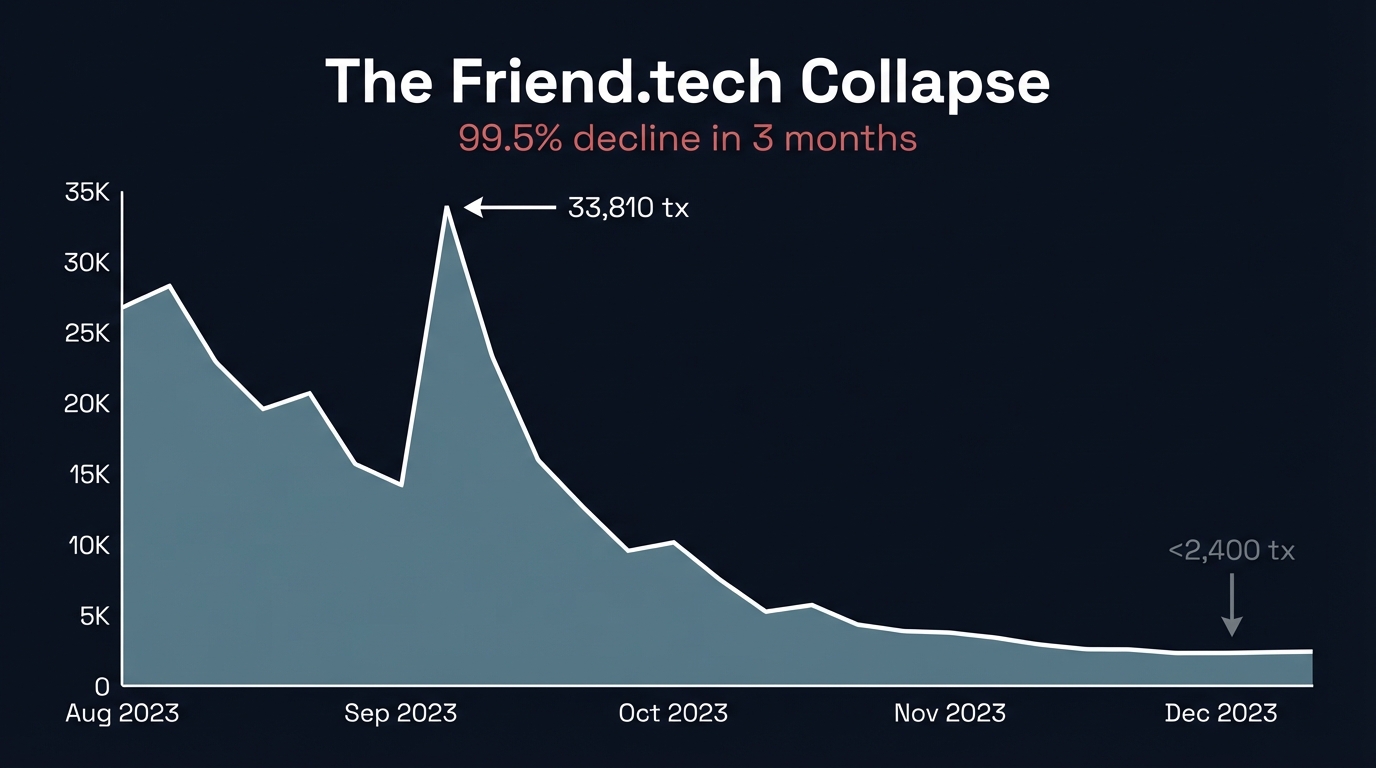

Friend.tech daily transactions peaked at ~33K in August 2023, collapsing to near-zero by late 2023 - 99%+ decline in months | Source: Dune Analytics @hakresearch

Friend.tech peaked at 539,810 daily transactions on September 13, 2023. By mid-December, it was under 2,400. That’s a 99.5% collapse in three months. The app still exists, but nobody uses it. All those “users” were speculators chasing returns, not genuine social network participants. When the ponzinomics broke, they evaporated overnight.

Now ask yourself: how much of Base’s current activity follows the same pattern? The memecoin du jour pumps 1000x, drives millions in volume, then dies. Rinse and repeat. Is that sustainable ecosystem growth or just gambling with extra steps?

Look at the TVL composition. How much of Base’s total value locked is actually productive DeFi (lending, derivatives, real yield) versus speculative positioning (memecoins, governance tokens waiting to dump, LP positions in dead pools)? Other L2s publish transparency reports breaking down TVL by category. Base’s numbers are impressive headlines without the underlying analysis.

I’d love to see a breakdown: what percentage of Base’s TVL is in stablecoins (productive), versus governance tokens (speculative), versus memecoins (pure gambling)? Arbitrum publishes this data. Optimism tracks it. Base… promotes total TVL without composition. That opacity is suspicious.

The post-incentive collapse is a known pattern. Optimism and Arbitrum both ran massive liquidity mining campaigns that pumped TVL to $2-3B, then watched 30-40% evaporate when rewards ended. Base’s $2.4B in net inflows over three months—how much of that is sticky capital versus mercenary liquidity chasing the next narrative?

Here’s a concrete test: when was the last time you heard about a Base-native protocol that generated real revenue? Aerodrome (the main DEX) is basically a Velodrome fork. Aave and Uniswap are multichain deployments, not Base-exclusive. What application exists on Base that couldn’t be replicated on Arbitrum in a weekend?

The real test comes when the Coinbase marketing machine stops promoting Base as the hot new thing. When “Onchain Summer” becomes “Onchain Tuesday in February” and nobody cares. When the airdrop farmers move to the next chain. What’s left? If it’s sustainable applications and genuine user adoption, Base wins. If it’s ghost town metrics propped up by Coinbase routing, that’s a problem.

I’ve watched too many “fastest growing chain” narratives collapse after six months to take short-term metrics at face value. Base needs to prove it’s different. The data isn’t there yet.

Where’s the Moat Beyond Distribution?

Strip away Coinbase’s brand and user base. What does Base offer that Arbitrum, Optimism, or zkSync don’t?

- Technology - Built on OP Stack, same as Optimism

- Fees - Competitive but not meaningfully cheaper than other L2s

- Speed - Similar to other optimistic rollups

- Ecosystem - Growing, but not yet matching Arbitrum’s DeFi depth

The entire bull case rests on Coinbase’s distribution advantage. If that’s the only moat, what happens when other exchanges launch their own L2s? When Binance, Kraken, or Robinhood deploy competing infrastructure?

The first-mover advantage in L2s isn’t as valuable as in L1s, because switching costs are lower and liquidity can migrate quickly.

Think about the exchange L2 race like the smartphone platform wars. Apple had iOS, Google had Android, and everyone else (Windows Phone, BlackBerry OS, Firefox OS) died. The market consolidated around two ecosystems with enough developer support and user liquidity to sustain themselves.

If every major exchange launches an L2, we’re heading toward a similar shakeout. Coinbase’s Base, Binance’s BNB Chain (already exists but could pivot to Ethereum L2), Kraken’s rumored solution, OKX’s potential play. The market won’t support ten exchange-branded L2s. Maybe it supports two or three.

Here’s where Base’s timing matters: they launched in August 2023 when “exchange L2” wasn’t yet a crowded category. If Kraken had launched six months earlier, or if Binance pivoted BNB Chain to Ethereum L2 architecture, Base’s first-mover story looks different. But they did move first, and now they’re racing to build enough ecosystem stickiness before competitors arrive.

Base’s first-mover advantage in the exchange L2 category matters—if they can build enough ecosystem lock-in before competitors launch. But here’s the problem: what’s the lock-in mechanism? Developers can fork and redeploy to any EVM chain in hours. Liquidity providers can migrate in minutes. Users can bridge in seconds.

iOS had app exclusives, developer tools, and ecosystem lock-in that made switching to Android costly. What’s Base’s equivalent? Every major Base protocol (Aerodrome, Uniswap, Aave) exists on multiple chains. There’s no Base-exclusive application that you lose access to by using Arbitrum instead. The switching costs are zero.

The potential second-order moat is more interesting: Coinbase’s compliance infrastructure, custody solutions, and fiat on-ramps. If they bundle Base access with their institutional custody offering, that’s a moat that competitors can’t easily replicate. BitGo or Fireblocks can custody assets, but they can’t offer the integrated exchange + L2 + custody + compliance package that Coinbase could.

Imagine this bundle: Coinbase Custody (institutional-grade asset storage) + Coinbase Prime (trading and services) + Base (onchain execution) + Coinbase’s regulatory licenses. That’s a vertically integrated stack that no other player can match. Kraken doesn’t have Coinbase’s institutional custody market share. Binance doesn’t have U.S. regulatory approval. Circle has the stablecoin but not the exchange. Coinbase has all the pieces.

But that’s also the worst-case scenario for decentralization. A future where enterprises use Base not because it’s the best L2, but because it’s the only L2 bundled with Coinbase’s institutional services. That’s not Ethereum scaling—that’s Coinbase capturing the enterprise crypto market behind regulatory walls.

The irony is perfect: Base succeeds by becoming the least crypto-native L2. Not through superior technology or community governance, but through traditional business advantages like regulatory licenses, institutional relationships, and service bundling. That might be great for Coinbase’s stock price, but is it great for Ethereum’s decentralization narrative?

The dependency risk cuts both ways. If Coinbase maintains dominance in U.S. crypto exchanges, Base rides that success. But if Coinbase loses market share to decentralized exchanges, non-custodial competitors, or international platforms, Base loses its primary distribution advantage. What happens to Base if Coinbase’s user count stagnates or declines?

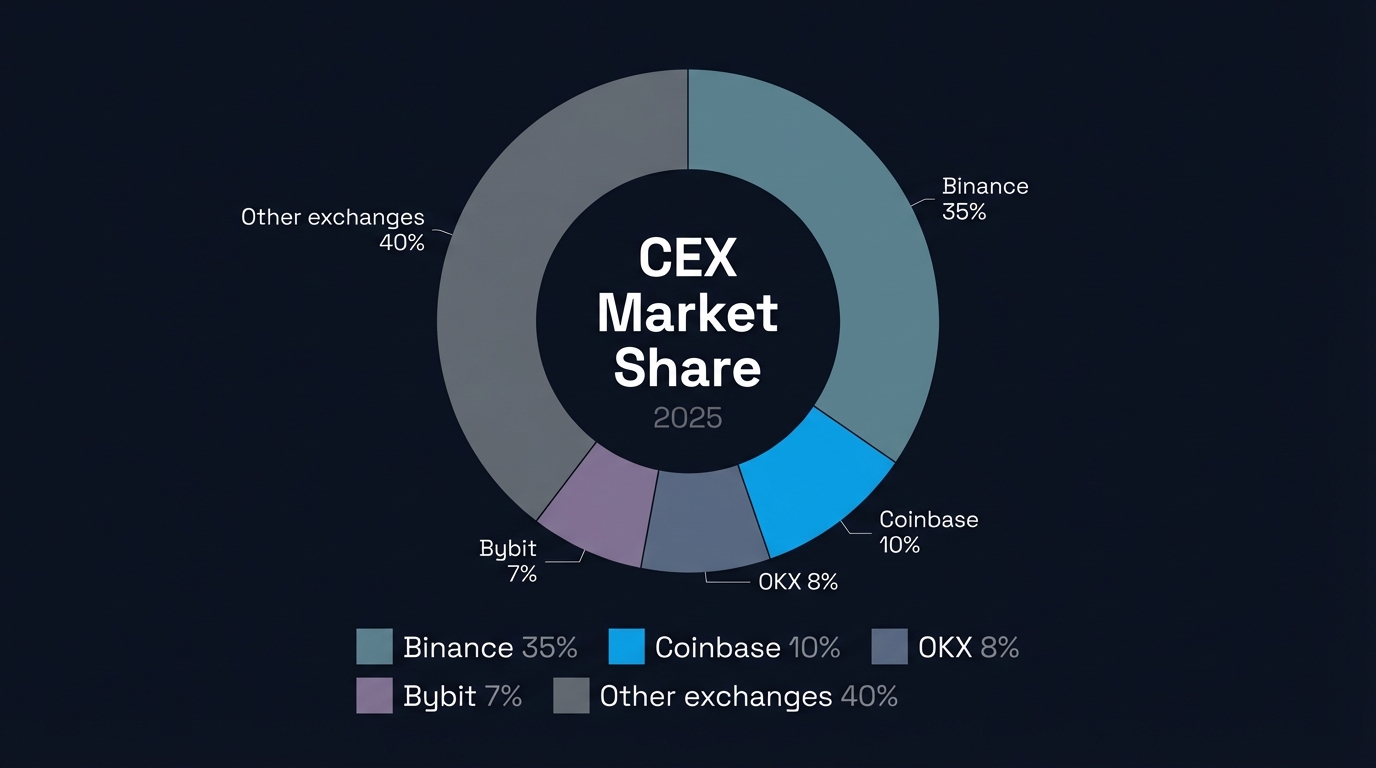

Centralized exchange market share by trading volume (Jan-Jul 2025): Binance dominates at ~35%, Coinbase (blue segment) at ~10% - down from 31% in 2022 | Source: CoinGecko Research

Look at Coinbase’s market position: they held 31.45% global exchange volume in January 2022, but by Q1 2024 that plummeted to 6.8%. In the U.S. market specifically, they peaked at 55% in March 2024 but fell to 41% by September as DEX volumes grew and competitors like Robinhood captured younger users. If that trend continues and Coinbase ends up as one exchange among many, Base becomes one L2 among many. The distribution advantage evaporates, and you’re left with an L2 that’s technically identical to Optimism but with more centralization.

The Verdict

Base sits in a fascinating position: too centralized for crypto purists, too crypto for traditional finance, and too dependent on Coinbase’s success for long-term infrastructure.

The bull case is simple: Coinbase’s distribution, regulatory positioning, and institutional trust create an onboarding ramp that no other L2 can match. If they successfully route even 10% of their users to onchain activity via Base, the transaction volume and ecosystem growth will justify the current momentum.

The bear case is equally clear: regulatory risk, centralization concerns, and L2 fragmentation create systemic vulnerabilities that could undermine Base’s long-term viability. The lack of a differentiated technical moat beyond “Coinbase runs this” is a real problem if competition intensifies.

My take? Base is a bet on regulatory clarity and institutional adoption winning over decentralization maximalism. If you believe crypto’s next billion users come through regulated exchanges rather than self-custody wallets, Base makes sense. If you think decentralization matters more than convenience, it’s hard to justify.

The $2.4B in net inflows suggests the market is betting on distribution over decentralization. Whether that bet pays off depends on factors outside Base’s control: Coinbase’s regulatory battles, Ethereum’s L2 scaling roadmap, and whether mainstream users actually care about blockchains at all.

I’m watching. Not buying BASE tokens (they don’t exist), but definitely paying attention to whether Coinbase can onboard normies at scale. Because if they can, the whole “which L2 wins” conversation becomes moot. Coinbase picks the winner by default.

Want to see how Base compares to other L2s in real-time?

This analysis is part of the Bear vs Bull series, breaking down blockchain infrastructure with data, not hype.

📧 Subscribe to the Newsletter | 🐦 Follow on Twitter/X | 💼 Connect on LinkedIn

Continue Reading:

- Bear vs Bull - Polygon - How Polygon lost its gaming focus

- Bear vs Bull - Solana - Can Solana flip Ethereum?

- 2025 Predictions: The Year Crypto, AI, and Gaming Redefine the Future - Where Base fits in 2025